Price action trading is better suited for short- to medium-term, limited-profit trades instead of long-term investments. Like any trading approach, it also carries risks, and success depends https://g-markets.net/ on a trader’s skill, discipline, and ability to manage risk effectively. There are quite a few of these out there, and we’ve talked about numerous such formations over the past few years.

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets plus spot metals with low pricing and fast, quality execution on every trade. In such a case, it is support which has been tested and which has held. That means that it is time to buy because price may be ready to rise. Basically, it is difficult to think of any reasons not to consider price action trading.

The Risks and Rewards of Forex Trading: How it Works

The bullish version of this price pattern is “Double Low Higher Close,” abbreviated as DLHC. As you would expect, this formation consists of two bars with lows which are very close together and the second bar closing above the first. The word pinbar is short for “Pinocchio bar.” You will understand why in a moment. This is a bar or candlestick where the open and close are close together, with the high or low protruding like a nose.

- For instance, if price approaches a strong resistance level and forms a bearish candlestick pattern, it may indicate a potential reversal and a signal to enter a short trade.

- Whilst the majority of my trades are following the trend of the market, I will occasionally take a counter-trend trade setup or a range-bound market trade.

- We looked at two different ways of playing Double-Spikes, both of which we’ve outlined in the following 2 charts.

- The inside bar breakout strategy involves identifying an inside bar pattern, which occurs when the price range of a candle is completely engulfed by the previous candle.

- In this beginner’s guide, we explain how to use technical indicators to improve your stock market trades.

If you can re-imagine the charts in these more abstract terms, it is easy to size up a security’s next move quickly. Not to make things too open-ended at the start, but you can use the charting method of your choice. Price action trading can be profitable if done correctly and consistently. When you come across a well-formed I4B, the standard procedure is to place entries above and below the formation.

When is london forex session?

We’ve also covered what a trading strategy is and what a good strategy should consist of. Think of the trading strategy as the signal you look for before entering a trade. The criteria that must be met in order for you to put money at risk.

It is smart to join one of these communities so that you have somewhere to post your own charts and ask questions of those with more experience. Your fellow traders can save you a good deal of time, confusion and stress by helping you to troubleshoot trades that have gone wrong unexpectedly. By keeping up with their charts, you can view examples of well-formed price patterns and solid context which can guide you in your efforts to learn to identify both. Eventually, when you have honed your own expertise, you can offer your wisdom back to the community and help out other traders who are just getting started. Price action traders believe that price movements are not random and that they follow a specific pattern. These patterns are formed by the continuous buying and selling of currencies by traders and investors.

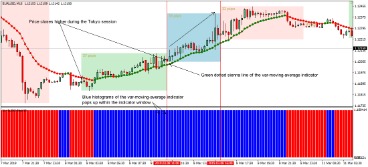

- Here’s an example of some traders’ charts that look something like the picture below.

- One thing to consider is placing your stop above or below key levels.

- Confirmation is when the price of a currency pair breaks through a key level or forms a price action pattern.

- It helps identify trends, breakouts, reversals and other price patterns that indicate market direction and strength.

- By contrast, price action relies only on the price movements of an asset within your trading timeframe.

I also trade the 4 hour time frame quite often, and occasionally the 1 hour charts, but I NEVER look at any time frame under the 1 hour. I have an arsenal of powerful price action patterns that I look for within the structure of the market. Whilst the majority of my trades are following the trend of the market, I will occasionally take a counter-trend trade setup or a range-bound market trade. Forex price action strategies allow traders to make decisions solely based on analyzing price movements without relying on indicators or external factors. While fundamental and technical analysis can make you a profitable Forex trader, there is no denying that these types of systems can get complicated fast.

How to Trade with Price Action, Part 1

What if there were a way that you could trade without getting lost among a dozen indicators on your charts? Imagine making trading decisions based how to trade price action in forex on the actual movement of price itself. Discover how to effectively use candlestick charting techniques to enhance your stock market trading.

If you’re interested in learning how I trade with simple price action strategies, checkout my Price Action Trading Course for more info. Utilizing trend lines and channels alongside price action analysis allows traders to ride trends and maximize their profit potential. Trend lines and channels play a crucial role in price action trading. A trend line is drawn by connecting consecutive highs or lows in an uptrend or downtrend. When price retraces and bounces off the trend line, it can serve as a potential entry point for trades in the direction of the trend.

Most recently, we highlighted five of the most common bearish reversal patterns in the article, Trading Bearish Reversals. So, regardless of the strategy – those same boring concepts of risk, trade, and money management are of the upmost importance to the trader. You need to think about the patterns listed in this article and additional setups you will uncover on your own as stages in your trading career. The real challenge is that it’s extremely difficult to trade purely on price.

Outside bars

It is one of the most approachable and dependable methods in existence. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. Learn how to trade the stock market during an economic recovery with our step-by-step guide. Master the art of stock market economic recovery trading with our expert tips and strategies.

Master the price action forex trading strategy with LonghornFX as your forex broker. When you see this pattern at a swing high, it signals a reversal, with price heading downward. The reason that the two highs formed close together is because there is too much resistance at that point for price to push higher. Indeed, during the second bar, it has been pushed aggressively lower, signaling the downturn. Get rid of the indicators, expert advisors; take off EVERYTHING but the raw price bars of the chart. Price action is a term often used in technical analysis to interpret and describe price movements of an asset.

Price action has an established community

To test drive trading with price action, please take a look at the Tradingsim platform to see how we can help. Price action traders are the Zen traders in the active trading world. Just to be clear, the chart formation is always your first signal, but if the charts are unclear, time is always the deciding factor.

Sunset Market Commentary – Action Forex

Sunset Market Commentary.

Posted: Fri, 08 Sep 2023 14:10:26 GMT [source]

This way, if the trend doesn’t continue and if a reversal comes into the market, you can exit the position before the loss becomes unbearable. Aggressive stops can be placed at the most recent swing-low, while more conservative stops can be placed below a previous swing (which is further away from current price). We explain this topic in the article, The Time Frames of Trading; and we even suggest potential time frames to be utilized by traders based on their desired holding periods. The below chart suggests two time frames, but traders can take this a step further by incorporating a third (longer-term) time frame to get a more full picture of what’s taking place in that market.

We’ll follow that up with another two-part series on position and risk management via price action. Most traders over-analyze the market and confuse themselves as a result, this ends up in them trading emotionally and losing money. Thus, I have no desire to sit in front of my computer screen staring at the 5 minute chart like a strung-out zombie-trader.

Support and resistance levels are key levels on a chart where the price has previously reversed. Traders use these levels to identify potential trade setups and to place their stop-loss orders. Price action is often subjective, and different traders may interpret the same chart or price history differently, leading to different decisions. Another limitation of price action trading is that past price action is not always a valid predictor of future outcomes.